Unlocking Corporate Capital: What the World’s Top Donors Reveal About Strategic Giving in Latin America

- Whitney Dubinsky

- Oct 10

- 4 min read

Across the globe, corporate giving is evolving, not just in scale, but in purpose and design. The Bridgespan Group’s recent analysis of the Top 20 Corporate Donors illustrates this shift with striking clarity. These companies, which include some of the largest global brands, now give hundreds of millions annually through strategic, often integrated approaches to philanthropy. For development actors in Latin America, including government agencies, NGOs, and entrepreneur support organizations, this presents a rare and timely opportunity.

At ALD Strategic Advisory, we view corporate philanthropy not as a side initiative, but as a core driver of economic and social transformation. Nowhere is this more urgent, or more promising, than in Latin America—a region rich in entrepreneurial potential, natural resources, and cultural capital, but historically constrained by fragile institutions and limited access to investment.

Corporate Giving: A Strategic Evolution

Once the domain of charitable foundations operating at arm’s length from corporate strategy, philanthropic giving is now increasingly embedded within core business models. Companies are aligning their giving with broader ESG mandates, supplier diversity goals, and inclusive growth strategies. The Bridgespan report reveals that top corporate donors are channeling funds into systemic issues, economic opportunity, education, healthcare access, and climate resilience, with a sophistication and long-term vision that mirrors impact investing more than traditional charity.

This trend is especially relevant to Latin America, where corporate capital can play a catalytic role in addressing longstanding structural barriers. When paired with smart policy and local knowledge, corporate funding becomes a mechanism for market creation—not just a reputational exercise.

Why This Matters for Latin America

Latin America stands at a critical crossroads. The region continues to face deep income inequality, limited access to formal finance, and persistent barriers to entrepreneurship—especially among women, youth, and Indigenous communities. Yet it is also a region of innovation and resilience. From agricultural technology in Colombia to fintech in Mexico and small business accelerators in Guatemala, Latin America’s private sector is increasingly stepping up to tackle local challenges.

What is often missing is the bridge, between high-level corporate intentions and grassroots execution. That’s where strategic advisory services come in. At ALD, we help development-focused organizations design credible proposals and partnerships that appeal to corporate donors not just as funders, but as strategic allies. We ensure that local initiatives align with corporate ESG goals and can demonstrate measurable returns—social, financial, and reputational.

For example, when a global consumer goods firm commits funding to support women in business, they often need implementing partners who understand both the cultural context and the reporting requirements. Similarly, when a tech firm wants to invest in digital education in the region, they must identify credible local actors, align with national policy, and ensure delivery in underserved areas. We help make that match—grounded in data, driven by outcomes.

Moving Beyond CSR to Co-Investment

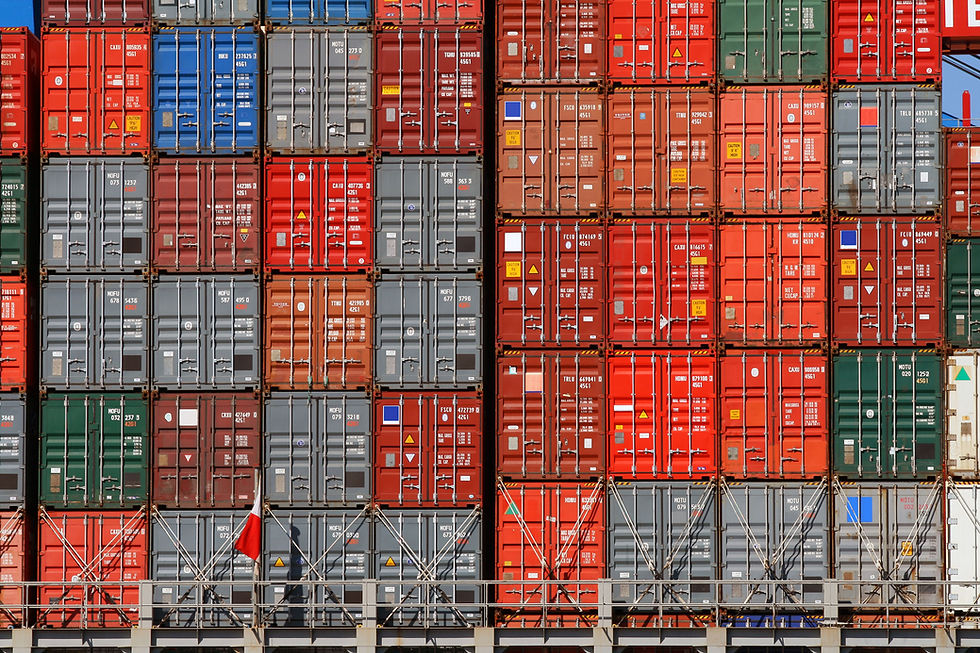

In Latin America, corporate giving is increasingly tied to long-term business interests. Companies involved in extractives, agriculture, logistics, or manufacturing often operate in rural or marginalized areas. Their social investments—whether in workforce development, community infrastructure, or entrepreneurship—are as much about business continuity as they are about community goodwill.

In countries like Guatemala, Honduras, and El Salvador, we are seeing early signs of this shift. Corporate donors are no longer satisfied with transactional grants. They seek measurable outcomes, aligned partners, and collaborative models that blend philanthropic and commercial goals. This opens the door to more sophisticated forms of capital mobilization, including blended finance, revolving funds, and impact-linked incentive structures, all areas where ALD offers technical and strategic support.

As former implementers ourselves, we understand how to translate development goals into investable propositions. Our work often involves convening stakeholders across ministries, private firms, and civil society to structure initiatives that not only meet donor criteria but deliver real results on the ground.

Seizing the Moment

The insights from the Bridgespan Group’s report confirm what we at ALD have seen in practice: that corporate giving is moving toward alignment with long-term market and sustainability objectives. For Latin American stakeholders, this represents more than a funding trend, it is a moment to reposition themselves as proactive co-creators of development solutions.

To do so, organizations must be prepared. This means developing strong value propositions, clarifying impact metrics, and demonstrating alignment with corporate priorities. It also requires agility—being able to adapt business models, engage across sectors, and communicate effectively with non-traditional donors.

At ALD Strategic Advisory, we provide the tools, insight, and facilitation to help organizations make this shift. We don’t just connect clients to funding—we help them build the strategic architecture to attract, deploy, and sustain capital in ways that transform communities and markets alike.

A Call to Action

If your organization is working to solve complex challenges in Latin America—whether through entrepreneurship, investment promotion, or inclusive finance—this is the time to engage with corporate donors in new and ambitious ways.

Let’s move beyond the traditional grant cycle. Let’s build partnerships that last. Let’s design funding models that work for both the private sector and the people they aim to serve.

#PrivateSectorEngagement #CorporatePhilanthropy #StrategicGiving #LatinAmericaDevelopment #BlendedFinance #FDI #InclusiveGrowth

Comments